Personal Money Saving Tips

‘Take care of the pence; for the pounds will take care of themselves’, William Lowndes, the British Secretary of the Treasury, 1696–1724.

Accountants like to save money. This trait is a consequence of years of studying and working with debits and credits. Here are some of the areas you should look at if you are looking to get your personal finances into a better place.

-

Consider cheaper accommodation

For most homeowners and renters accommodation costs consume 30-40% of take-home pay so it makes sense to start here when looking at how to save money. It’s normal to want to live in the best home in the most desirable and convenient neighbourhood. However, it does not make sense to do this at the cost of everything else in your life. Also consider mortgage rate negotiation, renting out a room, downsizing or lease negotiation.

-

Eat for cheap

Your food shopping and dining out budget are the next places to examine. My household has saved a small fortune in recent years by embracing a more affordable shopping basket. Also consider dinner parties, packed lunches, smaller portions, early bird options and standard cuts of meat.

-

Reduce your energy usage

Everybody needs to have a think about energy usage in their home. Is the hot water required 24 hours per day and do you really need to use the tumble dryer continuously? Remind yourself, partners and kids to be turning off lights, televisions and radios when not in use. 50 cent saving a day will add up to a few hundred euros by the end of the year. Switching your utility provider regularly to get the best rate is a no-brainer. Also, watch out for phone chargers being continuously plugged in.

-

Use cheaper forms of transportation

Public transport trumps car. Bicycle trumps public transport. Walking trumps bicycle.

-

Have fun for cheap (or free)

There are countless ways to have a good time without spending a lot of cash. Expensive concerts or festivals are probably not going to be life changing despite what others may say.

-

Avoid expensive addictions

Alcohol, nicotine and gambling are the obvious candidates, but everybody needs to be wary of shopping, online gaming and other addictions.

-

Remove luxuries from your budget

Eliminating luxury expenses is a great step to improve your financial situation because this won’t impact your quality of life or your ability to perform your work significantly.

Rob Madigan FCA CTC BCOMM, Financial Controller

Rob, a chartered accountant, is the FC for Neworld, a creative branding agency with over 30 years’ experience developing brands to position them for future growth. He has worked with Neworld since September 2008 and guided the company through interesting waters. Rob admires greatly his colleagues’ creativity, energy, and enthusiasm for their work and is happy to be a little part of the show. He previously worked in accountancy with PWC and Madigan + Co and in hedge fund administration with Citco Fund Services Dublin.

Keep Reading

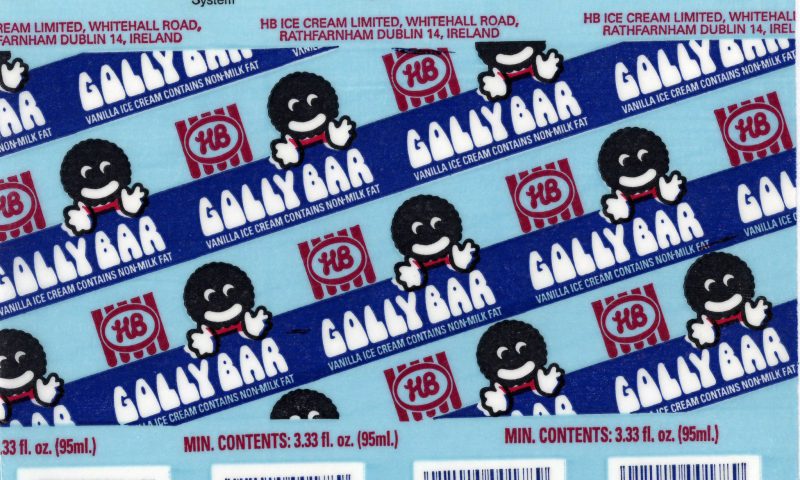

Packaging in Ireland’s Oldest Market

Creative People Are Complex – 10 Contradictory Traits...

Designer OCD

Ireland’s mobile internet habit

Is Craftsmanship Dead?

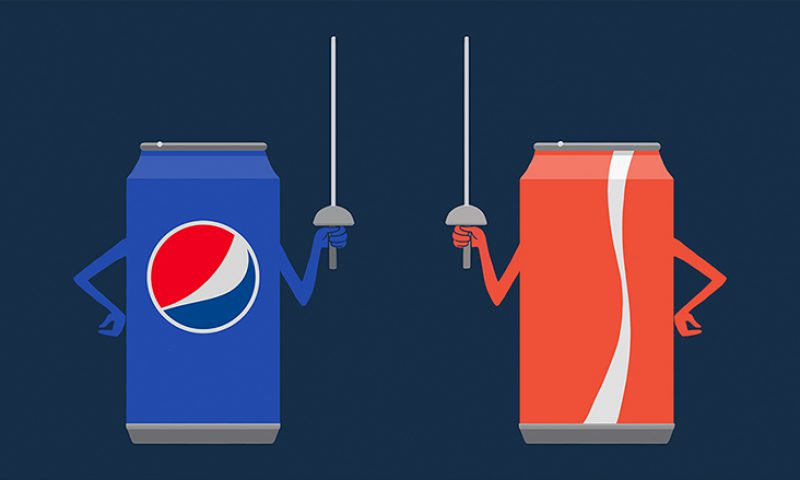

Pepsi vs. Cola: The Marketing Battle of the Century

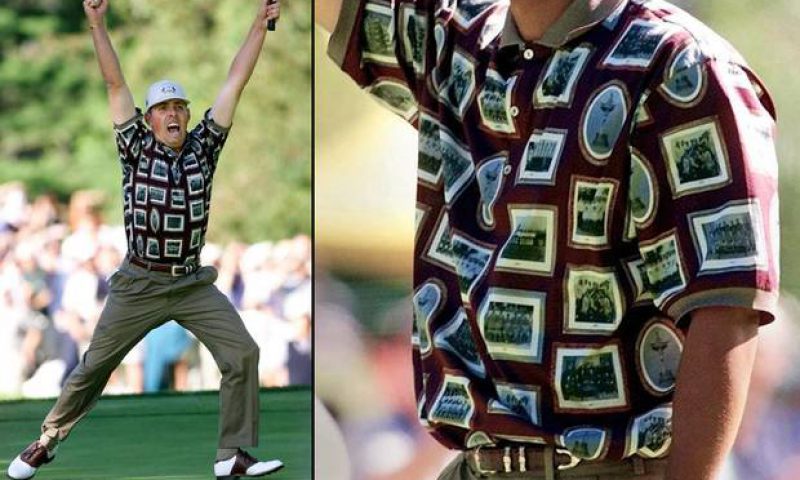

The Ryder Cup – team branding gives them the edge

Why Do I Have A Passion for Shoes

World first for the beer industry: Carlsberg sticks it to...

Using Pastels for Packaging Impact

It takes a village (the right team) to build a brand

Packaging Design – Not just for profit

Let’s Get Mischievous

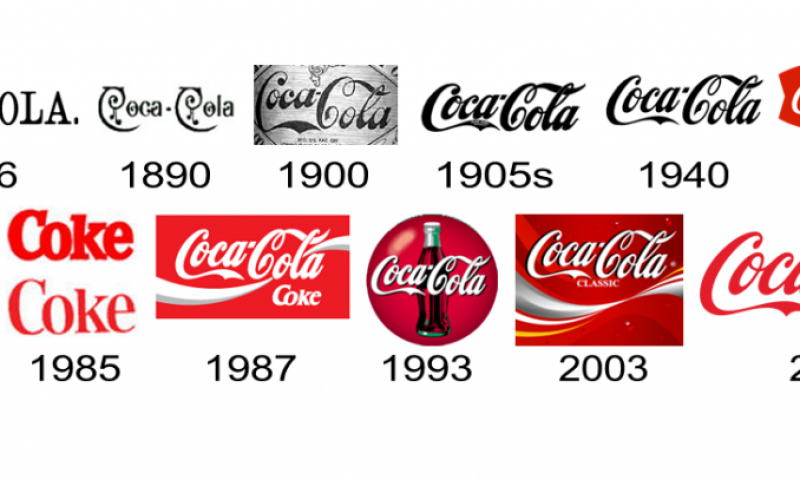

The Importance of Keeping Your Brand Fresh

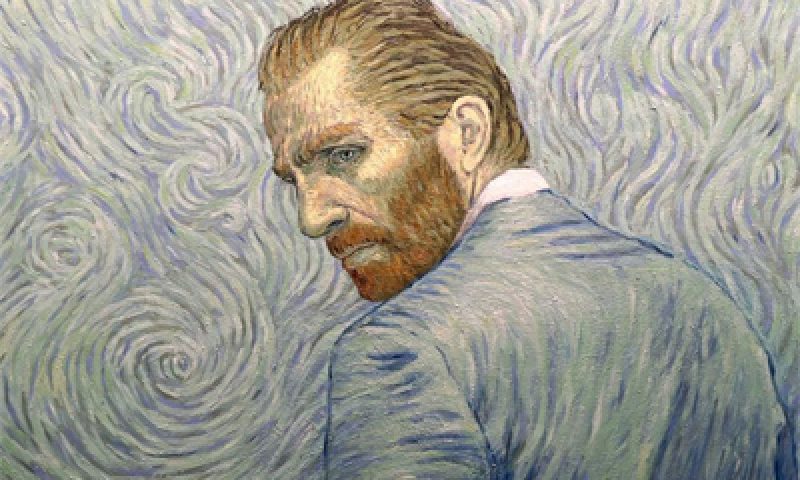

Loving Vincent

Happy World Tourism Day!

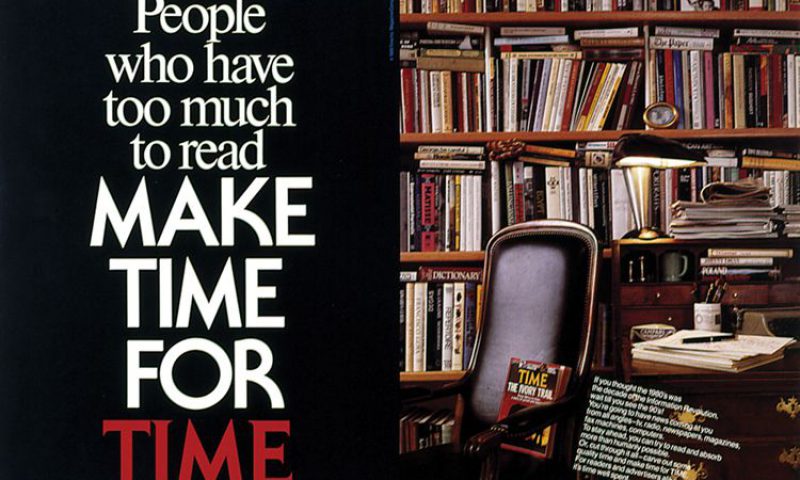

Curves, Swirls and Virgins – the world of media...

When a Slogan Fits, It Sits

Optical Illusions